38

subscribers

Can't Join? t.me/sandyforswing

38

subscribers

Updated: Jan 1, 2026

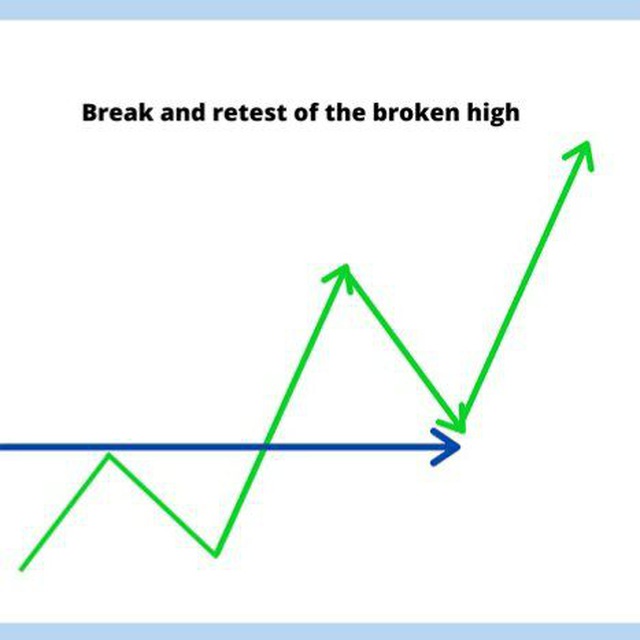

Breakout trading,BUY on LOW and SELL on HIGH strategy

sandyforswing

May 6, 2025, 17:19

🟢 RPG ishga tushdi!

sandyforswing

May 6, 2025, 17:19

🔴 RPG o‘chdi! Uptime: 471 sekund.

sandyforswing

May 6, 2025, 17:11

⚡ *RPG rejimi yondi!*

⏳ Yuklanish vaqti: 1510 ms

📦 Yuklangan pluginlar: 17

⚙️ TPS: 20.0000105513389

👥 Onlayn o‘yinchilar: 0

🔓 Bo‘sh slotlar: 20

sandyforswing

May 6, 2025, 17:11

🟢 RPG ishga tushdi!

sandyforswing

May 6, 2025, 17:11

🔴 RPG o‘chdi! Uptime: 612 sekund.

sandyforswing

May 6, 2025, 17:01

⚡ *RPG rejimi yondi!*

⏳ Yuklanish vaqti: 1842 ms

📦 Yuklangan pluginlar: 17

⚙️ TPS: 20.00002685570273

👥 Onlayn o‘yinchilar: 0

🔓 Bo‘sh slotlar: 20

sandyforswing

May 6, 2025, 17:01

🟢 RPG ishga tushdi!

sandyforswing

May 23, 2025, 12:15

Bitcoin buyers remain dominant and optimistic as the price reaches new all-time highs above \$110,000, with data from CryptoQuant showing a strong 90-day buy volume trend and short-term holders firmly in profit. This buying pressure suggests the uptrend may continue, especially as sellers lose influence and long-term holders resist cashing out. Daily profit-taking is significantly lower than during Bitcoin’s first rise to \$100,000, reflecting increased holding behavior and a potential setup for further gains.

sandyforswing

May 22, 2025, 6:33

A crypto whale known as “James Wynn” has shocked the community by expanding a 40x leverage long Bitcoin position to \$1.13 billion on the decentralized exchange Hyperliquid — the platform’s first-ever trade exceeding \$1 billion. Using a \$28.4 million margin across multiple trades, Wynn entered Bitcoin at an average price of \$108,065 and is now up \$36 million as BTC surged past \$110,000. Active on Hyperliquid for just two months, Wynn describes himself as a high-risk leverage trader and memecoin enthusiast, with past trades including XRP, TRUMP, FARTCOIN, and TON.

sandyforswing

May 21, 2025, 6:44

Blackstone, the world’s largest alternative asset manager, has made its first move into crypto by investing \$1.08 million in BlackRock’s spot Bitcoin ETF (IBIT), according to a May 20 SEC filing. As of March 31, it held 23,094 IBIT shares within its \$2.63 billion Alternative Multi-Strategy Fund. The firm also purchased 9,889 shares of the ProShares Bitcoin ETF and 4,300 shares of Bitcoin Depot Inc. Despite CEO Steve Schwarzman’s past skepticism about crypto, Blackstone’s small step into the space comes as BlackRock’s IBIT continues its strong momentum, with over \$46.1 billion in net inflows since launching in January 2024 and no outflows since April 9.